Electronic Invoice with PuenteSIF

Electronic Invoice

What is the electronic invoicing or e-invoicing?

An electronic invoice is an invoice that is issued and received in electronic format and is capable of being transmitted through electronic communications networks, such as the Internet.

There are two types of electronic invoice:

- Electronic invoice with a structured format, for example, the Facturae, which facilitates its automated processing. However, it is not readable by a natural person.

- Electronic invoice in an unstructured format, such as PDF, consisting of an image that can be read by a natural person, but which requires manual intervention or optical recognition (OCR), not always successful, to introduce it into the recipient’s accounting system.

Royal Decree 1619/2012, of November 30th, establishes the rules that invoices must comply with, both on paper and electronically. And, above all, it regulates that they must guarantee legibility, authenticity and integrity.

Register for the B2B Electronic Invoice Webinar and find answers to your questions directly with our consultants

Who is obliged to issue electronic invoices?

In 2014, the European Union promoted the implementation of electronic invoicing in its member states, establishing a mandatory common format in European B2G relations.

On January 15th, 2015, the obligation to use the Facturae electronic invoice format came into force for any invoice addressed to Public Administrations, sending them through the FACeB2B electronic platform provided by the Ministry of Economic Affairs and Digital Transformation.

The issuance of the rest of the electronic invoices was conditional on the recipient’s consent. Therefore, the electronic invoice is a legal alternative to the traditional paper invoice.

However, this changes with the new Law 18/2022 on the Creation and Growth of Companies, better known as “Ley Crea y Crece” (Create and Grow Law), of September 28th, 2022, which establishes electronic invoicing as the only system that can be used in Spain in commercial transactions between companies and freelancers (B2B). Initiative born with the aim of promoting digitization and fighting late payment.

In addition, on 5 November 2024, ECOFIN gave the green light to the VIDA project, which requires all intra-community transactions to be invoiced in a European structured electronic format from 2030 or from 2028 on a voluntary basis.

Issue and receive electronic invoices and continue working as you have been until now. We adapt to your ERP. Our PuenteSIF Platform takes care of everything.

Take the time you need to observe how your organization adapts, then efficiently plan how to optimize and automate processes, if you see fit. You choose the pace of your business’s digitalization.

Deadline: Companies with a turnover of over €8 million have 12 months to adapt, while the rest have 24 months.

Scope: The requirement applies to all invoices between businesses and professionals, excluding cross-border transactions and tickets.

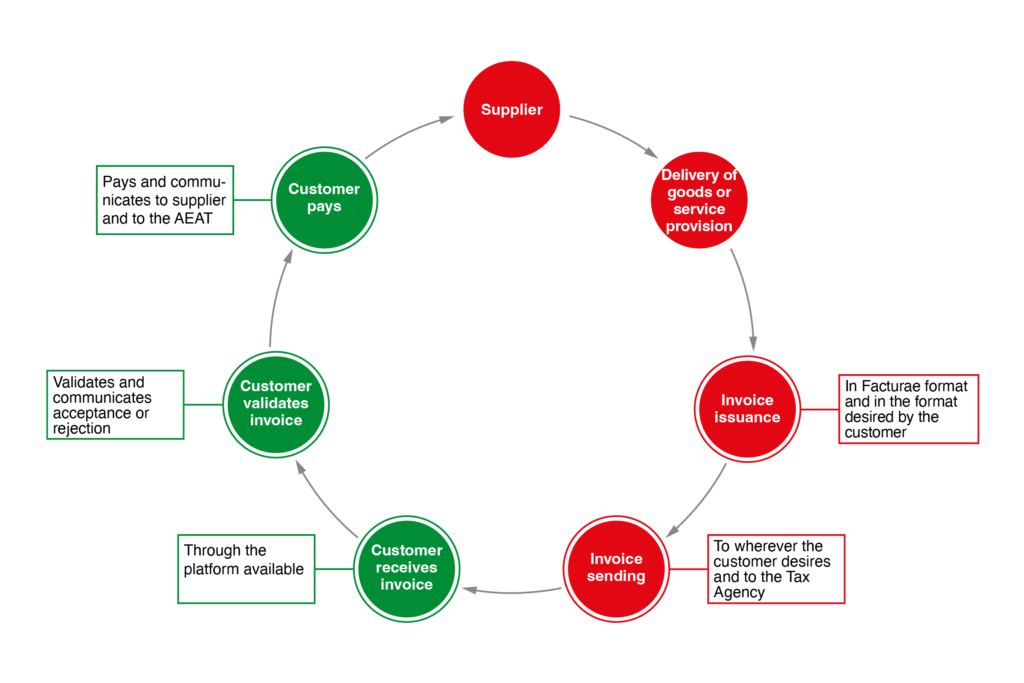

Issue electronic invoices in one of the 4 allowed formats, chosen by the client.

Immediately send the invoice to the AEAT and to the platform chosen by the client.

Receive invoices from suppliers in structured electronic format.

Report the invoice status to the Tax Agency within 4 days: Acceptance, Rejection, and Payment date.

- Anticipate the change with clients and suppliers, taking advantage of the unlimited testing environment offered by PuenteSIF.

- Imagine an automatic process for validating electronic invoices and decide what information you want each supplier to provide on their invoice. PuenteSIF customizes it for you.

- Transform the received electronic invoices into a readable format for manual accounting, and weigh the benefits of a standardized, ready-to-automate format. With PuenteSIF, you can do it both ways.

- Consider automating the payment communication process from your treasury management systems. With PuenteSIF, you can do it both manually and automatically.

- Choose the pace of digitalization that suits you. With PuenteSIF, it is not necessary to do everything at once.

- Get support from our expert consultants in both IT and fiscal regulations during the implementation and throughout daily operations.

When does the electronic invoicing obligation come into force in B2B?

In March 2025, the Ministry of Economy launched a public consultation on the third draft of the regulation outlining the technical and informational requirements for B2B electronic invoicing under the Crea y Crece Law. Although there is still no official date, it is already known that:

- Companies with a turnover of more than €8M will have 1 year to implement it, after the publication of the regulations.

- The rest of the companies and freelancers will have 2 years to adapt.

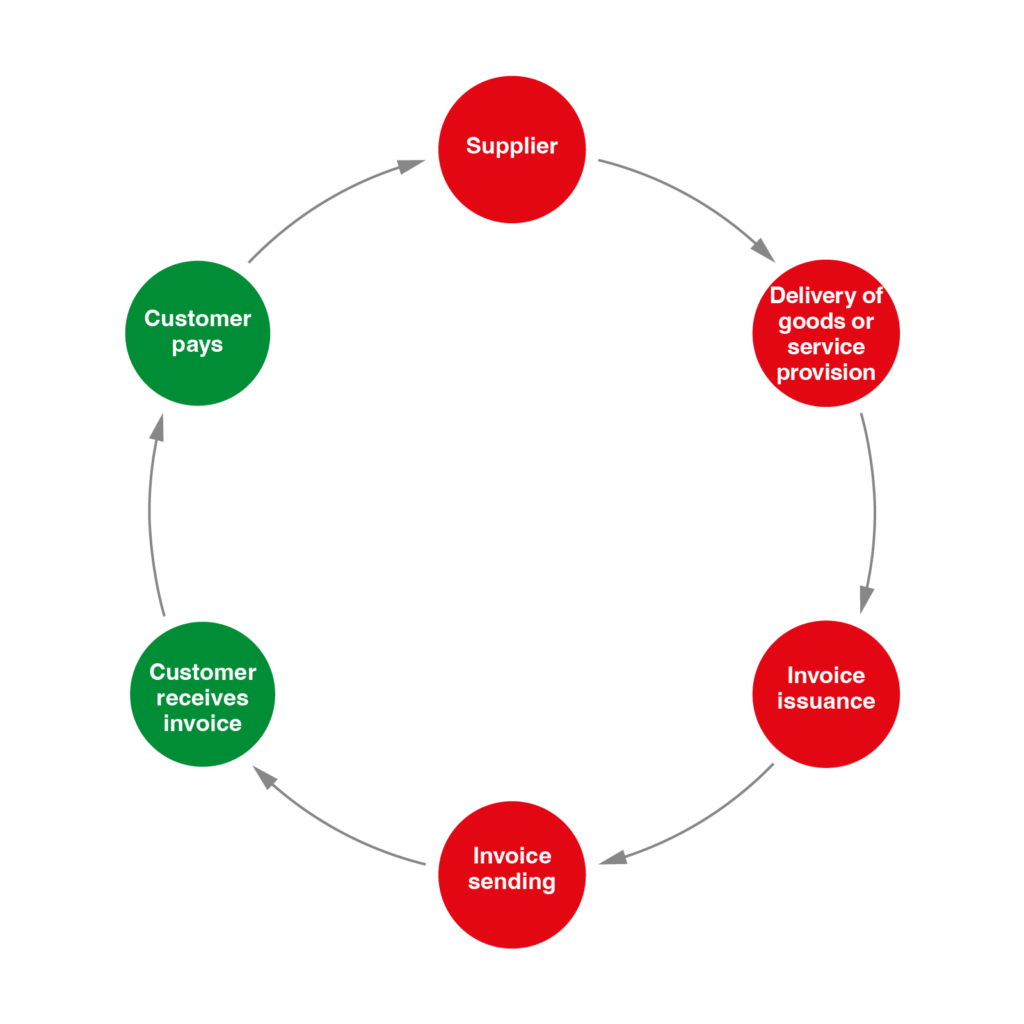

What other implications does mandatory B2B electronic invoicing have?

In the absence of the publication of the technical regulation that regulates the new electronic invoicing system, the law contemplates the following obligations in the private sector:

- Obligation to issue, send and receive electronic invoices in their commercial relations with other companies and professionals.

- Both the recipient and the issuer must provide information on the status of the invoices.

- Providers of technological solutions or platforms must guarantee free interconnection and interoperability between them.

- Recipients of electronic invoices may not force their issuer to use a predetermined electronic invoicing solution, platform or service provider.

- Recipients will be able to request free access to electronic invoices for 4 years. Even in the case of having ceased to be clients of the issuing companies, they must allow their access during the 3 years after the end of the contracts.

- The electronic invoice must include information that allows control of the payment date and facilitates the calculation of the average payment period.

- Sanctions for non-compliance can reach up to €10,000

Issuing Electronic Invoice

(4 Formats)

Sending to Client Platform + Tax Agency Platform

Receiving Electronic Invoice

Reporting Acceptance and Payment

(4 days)

Advantages of issuing in Electronic Invoice format

Less human errors, thanks to process automation

Avoid providing a physical space for storage

Greater sustainability, eliminates printing costs, paper consumption and postage

Digitizes and optimizes commercial transactions, providing greater security and facilitating collection

Faster, more agile and easier access to stored invoices

Facilitates the fight against fraud, makes it impossible to manipulate invoices

Download the B2B Electronic Invoice EBOOK with technical and legal specifications established by Create and Grow Law

How can we help you comply with electronic invoicingunder the Create and Grow Law?

If your ERP does not have an electronic invoicing module, there’s no need for complex changes or migrations. Our PuenteSIF platform integrates securely and non-intrusively through a simple API call, without accessing your internal systems.

Compatible with any ERP (SAP, Microsoft Dynamics, Baan, Navision, SAGE X3, Murano, AS/400, Oracle, AX, Movex, M3 Infor, JD Edwards, IBM iSeries, custom or proprietary ERP…), PuenteSIF functions as an external bridge that meets all the requirements of the Crea y Crece Law, facilitating invoice issuance, reception, traceability, and connection with the AEAT, becoming your electronic invoicing system.

With PuenteSIF you can continue working as before. PuenteSIF will be in charge of exchanging the information required by the Create and Grow Law with the platforms of your clients and suppliers, as well as with the AEAT (Tax Agency).

With the Electronic Invoicing Module of our PuenteSIF Platform you can choose to receive electronic invoices from your suppliers in a friendly format and continue accounting for them manually or you can, by customizing the necessary fields, automate their integration for subsequent automatic accounting.

Likewise, you can also communicate the status (ACCEPTANCE, REJECTION and PAYMENT) of your electronic invoices manually or automatically.

Our Electronic Invoicing Module in accordance with the Create and Grow Law provides companies with the possibility of generating and issuing invoices in structured electronic format and in PDF format, generated by their ERP or by the platform itself, also linking with the VeriFACTU Module if your invoices require to also be Verifiable Invoices.

Features of our Electronic Invoicing Module

This Electronic Invoicing Module in accordance with the Create and Grow Law of our PuenteSIF Platform hosted in the cloud and easily accessible through a link, facilitates the possibility of the platform itself receiving, issuing and sending the invoice to its recipients.

To do this, it has the following functionalities:

- Integrable into any ERP via Restful Call to our API

- Uploading of data via API to generate an electronic invoice, as well as manual upload

- Unlimited issuance of electronic invoices in any of the authorized formats and in PDF format.

- Receipt of electronic invoices in structured format allowed.

- Inclusion of personalized fields in the invoice file, both for the client and in the one sent by the suppliers.

- Communicate the acceptance and payment statuses of electronic invoices.

- Receive acceptance and payment status communications from recipients.

- Interconnection and interoperability with other platforms or technological solutions guaranteed.

- Invoices are sent both to the AEAT and to the platform or technological solution selected by the client.

- Invoice storage capacity during the legally established periods.

- Download of electronic invoices, both in PDF format and in structured format, without limit or additional cost during the legally required periods.

- Client Portal and Recipient Portal, for consulting the history of electronic invoices, included.

- Integration Option with PuenteSII Platform: It allows the sending of invoices to the SII (Immediate Supply of VAT Information)

- Integration Option with the VeriFACTU Module of the same PuenteSIF Platform: It allows the sending of registration and cancellation records of verifiable invoices to the AEAT, as well as the inclusion of the QR code on the invoice, both in structured format and in PDF.

Please fill out the form to register next

Free B2B Electronic Billing Webinar according to the “Create and Grow” law.

You will receive the available dates and times shortly.

Complete this short questionnaire to download B2B Electronic Invoice EBOOK: technical and legal specifications